NovusQuo market release

Faltering economy and dampened demands

Feb 19, 2025

BHP’s Profit Slump Prompts Hefty Cut to Interim Dividend.

Bloomberg announcement

[Bloomberg] BHP Group Ltd. said first-half profit slumped 23% as China’s faltering economy dampened demand for iron ore, prompting the miner to cut its interim dividend to an eight-year low.

Underlying attributable profit for the six months to Dec. 31 was $5.08 billion, below analyst estimates of $5.39 billion.

BHP’s move to cut its dividend to 50 cents a share, down from 72 cents the year before, will reinforce speculation the board has a renewed focus on capital management as it pursues growth. Analysts were anticipating a dividend of 53.3 cents.

Impact on iShares S&P/ASX20 ETF

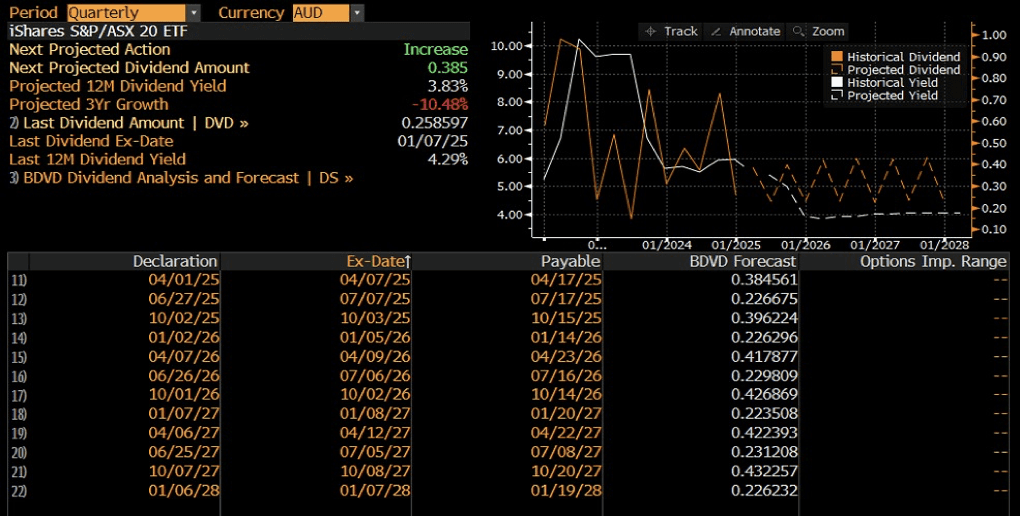

The impact of the BHP dividend cut on the iShares S&P/ASX20 ETF sees the Projected 12M Dividend Yield fall to 3.83% from the Last 12M Dividend Yield of 4.29%.

Impact on NQ ETFs

The dividend cut when combined with the Official Cash Rate as determined by the RBA cut to 4.1% sees the impact on Novus Quo Dividend and Capital units is as follows.

Impact | Before | After |

|---|---|---|

ILC: AU Share Price ($): | 32.47 | 32.47 |

Risk Free Rate (%): | 3.83 | 3.85 |

Issuance Capital Unit ($) | 16.67 | 17.97 |

Issuance Dividend Unit ($) | 15.80 | 14.50 |

Dividend Yield (%) | 4.29 | 3.83 |

Growth Exposure: | 1.95 | 1.81 |

Effective Yield (%): | 8.8 | 8.60 |

Growth exposure represents the multiplier that magnifies the upside return for Growth Unit Investors.

Effective yield represents what a dividend unit investor expects to receive when they hold to maturity.

Get in touch

Please get in touch for information or assistance in relation to NovusQuo ETFs.